In the labyrinth of finance, a wealth management consultant is like your savvy tour guide, leading you through the zigzags of investments, savings, and ensuring your dinero works as hard as you do. Let’s dive into understanding what these money maestros offer, what it’ll cost you, and why that long-term relationship is gold.

Navigating the Financial Maze

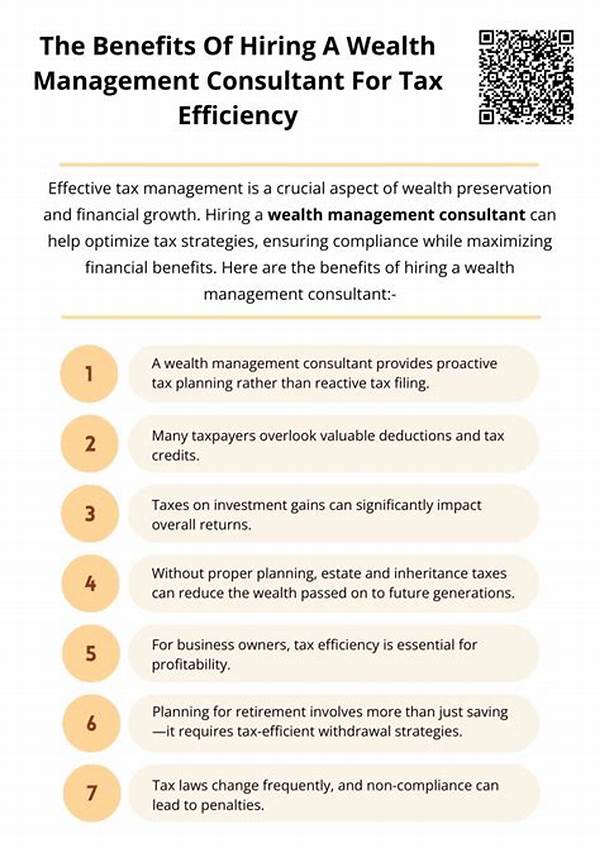

Let’s face it, money talk can sound like hieroglyphics if you’re not fluent in the language of finance. Enter the wealth management consultant, your financial GPS. These folks help in mapping out the terrain with services that range from investment advice, retirement planning, tax efficiency, and handy insights into keeping—and growing—your cash stash. It’s not just about throwing money at stocks; it’s holistic wealth guidance, baby!

But, what’s the damage to your wallet? Well, typically, wealth management consultants operate on a fee structure—think of it like a Netflix subscription for your money strategies—ranging from flat fees to a percentage of assets under management. It’s crucial to know upfront what you’re spending to avoid any surprise charges later. Yeah, you gotta pay, but it’s like investing in a wardrobe staple—timeless and versatile.

When it comes to the long-term play, having a wealth management consultant in your corner is akin to having a seasoned coach. They keep you disciplined, help you dodge financial pitfalls, and set you on a path to financial victories. Wealth management consultants do more than just help with the here and now; they set you up for living large in the future. That, dear friends, is what makes the costs worthwhile in the game of services, costs, and long-term benefits.

Unlocking the Mysteries of Wealth Management

1. Holistic Financial Planning: These consultants aren’t just about the Benjamins; they take a 360-degree approach to your finances. It’s like getting a life coach for your money.

2. Personalized Investment Strategy: Forget cookie-cutter solutions. Your wealth management consultant crafts an investment game plan that’s more tailored than your fave bespoke suit.

3. Expert Tax Advice: Taxes can be a nightmare, but with expert advice, it’s a smooth sail. Consultants ensure you keep more of that hard-earned money.

4. Estate Planning: They lay out the goodies—and not-so-goodies—of estate planning, avoiding headaches for your loved ones down the line.

5. Risk Management: These pros offer strategies to balance risk and reward, ensuring you’re not putting all your eggs in one basket—or crypto.

By focusing on how wealth management consultant services, costs, and long-term benefits intersect, you’re armed with the knowledge to navigate your financial journey with swagger and intelligence.

The Core of Financial Empowerment

Engaging a wealth management consultant is like stepping into the financial gym, where they are your personal trainers. They customize your financial workout, targeting specific growth areas and crafting a master plan for your money to get ripped. Say goodbye to financial flab and hello to robust investment portfolios. It’s all about that financial muscle, peeps, and a consultant is your secret weapon to ensure services, costs, and long-term benefits align perfectly.

Think of a consultant as an artist, brush in hand, painting your financial future. They balance colors (or investments) on your monetary canvas, ensuring each stroke leads to a picture of financial nirvana. It’s not just about the immediate returns; it’s setting up that masterpiece to be admired—and to provide—over the decades.

A wealth management consultant doesn’t just throw theories at you; they execute with precision. These financial artisans are constantly refining their strategies, much like an evolving art form, aligning their services, costs, and long-term benefits to reflect the ever-changing market dynamics. The goal? To fortify your financial edifice so it withstands the test of time, market slumps, and life’s little surprises.

Strategizing for the Win

1. Communication is Key: Stay in the loop with regular consultations to ensure your financial goals are on track.

2. Monitor and Adjust: Like your wardrobe, financial plans need regular updates to reflect life changes and market conditions.

3. Leverage Technology: Use financial software and apps recommended by your consultant to streamline your financial processes.

4. Stay Educated: Attend seminars or webinars to stay informed about the latest financial strategies and policies.

5. Invest in Relationships: Build a rapport with your consultant; the better they know you, the more personalized your financial strategy becomes.

In the grand tapestry of wealth management consultant services, costs, and long-term benefits, these strategies are your thread, weaving through and ensuring a robust financial future.

Crafting the Wealth Journey

With each session you have with a wealth management consultant, you’re not just tweaking numbers; you’re sculpting your financial legacy. Sure, the costs raise eyebrows at first, but hey, quality craftsmanship ain’t cheap—but neither are the rewards. It’s a commitment to a long-term partnership that pays dividends, literally and figuratively.

You’re in this wealth game for the long haul, and consultants are your dodgeball teammates ready to help you avoid the financial balls life hurls your way. As your partnership evolves, the nebulous becomes clear, and what once seemed unattainable turns into traveling, funding college tuition, or artfully resigning to bask in retirement sunshine.

Tomorrow’s Financial Confidence

Harnessing the services of a wealth management consultant isn’t just about immediate gains; it’s about laying down roots for a future bloom. With every financial milestone, the value of your consultant’s role becomes apparent, making services, costs, and long-term benefits all the more pivotal. It’s a roadmap to tomorrow’s financial security drawn today—a plan that thrives as it ushers in fiscal freedom with panache.

While it’s a world where costs can pinch, and plans can change the game, remember that engaging with a wealth management consultant: services, costs, and long-term benefits is a proactive move towards your prosperous future. Head up, stay informed, and let your financial stories unfold with style and strategy.