In the dynamic world of corporate finance, having a savvy consultant by your side can make all the difference. These financial wizards are like the secret weapon businesses need to navigate the complex maze of economic decisions and strategies. Whether you’re a startup figuring out funding or a well-established firm looking to optimize financial performance, a corporate finance consultant can offer invaluable insights. But what exactly do they do, how much do they charge, and more crucially, what are the potential business benefits? Let’s dive in and explore!

What a Corporate Finance Consultant Brings to the Table

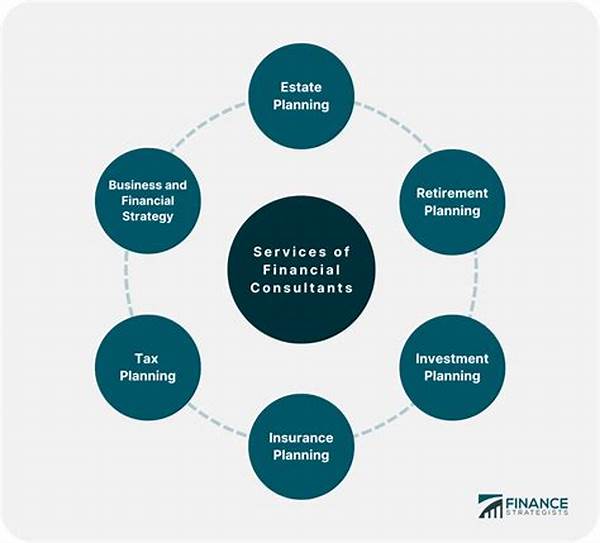

Alright, imagine your business as a ship sailing through the sometimes-turbulent seas of the financial world. A corporate finance consultant is like your ship’s navigator, charting the best course and avoiding the financial icebergs that might lurk ahead. These consultants are pros at assessing company finances, creating killer strategies for growth, and ensuring everything stays on track. They provide services that range from conducting financial analysis, restructuring debts, and optimizing cash flows, to major tasks like mergers and acquisitions. Their expertise doesn’t come cheap, though. Fees for a top-notch corporate finance consultant can range widely, depending on the complexity and scope of the services required. But here’s the kicker: the business benefits can far outweigh these costs when you think about the potential for increased profitability and tactical financial advantage.

Now, let’s keep it real. Sure, hiring a corporate finance consultant sounds like an expense, but think of it as an investment. The services they provide often translate into measurable gains for a business. Imagine better cash management strategies that pump up your working capital or tax optimization plans that let you keep more of your hard-earned money. These consultants can also open doors to financing opportunities you weren’t even aware of — like that VIP party you didn’t know existed. The corporate finance consultant’s role in aligning financial strategies with the business goals is paramount, and that often results in streamlined operations, mitigated risks, and an improved bottom line. So, the business benefits speak for themselves.

It’s not just about the big ticket items either. Corporate finance consultants can help refine the nitty-gritty of your financial practices. They’re the gurus who can spot inefficiencies in your accounts payable process that no one else has noticed. They provide a fresh perspective and a deep understanding of market trends – essentially, they’re your in-house crystal ball for financial futures. Whether it’s navigating complex regulations or making critical investment decisions, these consultants are trained to maximize corporate finance opportunities, ensuring that your business is not just keeping afloat, but sailing smoothly towards greater success.

Costs and What Influences Them

Okay, let’s talk dough, because when it comes to corporate finance consultant services, fees, and business benefits, budget is a key consideration. While it’s easy to get hung up on the costs, it’s crucial to understand the value these experts bring to the table. There are a few things that influence how much they charge. First up, it’s the size and complexity of your business. Larger corporations with multifaceted structures and global operations tend to pay more than smaller firms. Then there’s the range of services you need. A one-off project like evaluating investment opportunities will cost less compared to a full-time retainer, keeping them on speed dial for every financial query that crops up.

The level of expertise and reputation of the consultant also plays a big part. Top-tier consulting firms with a track record of success justify their higher fees because, well, they deliver results that can transform business fortunes. Location can influence costs too; consultants based in big financial hubs might charge more than those in smaller markets. But here’s the real talk: when you weigh these fees against the potential business benefits, like enhanced profitability, improved financial control, and strategic growth, it often becomes clear that opting for a corporate finance consultant is not just a cost but a savvy investment in the future of your business.

Navigating the Selection Process

Ah, the crucial task of selecting the right corporate finance consultant. Picture it like speed dating but for your business’s financial future. You’ve got to click, there’s got to be trust, and they better know what they’re doing, right? Start by scoping out their track record. Have they been successful with firms like yours? Do they have insights into your industry? Their credentials matter because you’re not just looking for a numbers whiz; you want someone who can dive into the unique quirks of your business and come up with gold-standard solutions.

You also have to get down to the nitty-gritty of their specialty areas. Maybe your business is staring down the barrel of a massive merger, or perhaps you’re looking to expand into new markets. Not every corporate finance consultant will be the right fit for every financial challenge. Asking about their approach and understanding of contemporary market trends can unveil whether they align with your corporate vision. Remember, good communication and transparency about services, fees, and benefits are vital. The best consultants aren’t just about telling you what you want to hear; they’re about delivering the truth, even if it’s the tough kind.

Possible compatibility isn’t the only thing on the checklist, though. You have to ensure they provide clear forecasts and measurable outcomes so you can really gauge the business benefits they bring. Basically, you want them to break down complex financial lingo into straightforward advice and actionable steps. The real win? Finding a consultant who not only implements strategies but empowers your team with the knowledge to maintain financial health even long after their contract ends.

Real-Life Benefits: A Case Study Approach

The power of a corporate finance consultant: services, fees, and business benefits are best appreciated through real-life success stories. Take, for example, a mid-sized tech firm that was on the brink of expansion. They brought in a corporate finance consultant to give their financial plans a once-over. What happened next was a blast of fresh air through their financial operations. The consultant identified inefficient capital allocation and set up a streamlined budgeting process, both of which had immediate positive effects. They then crafted a robust financial strategy that aligned perfectly with their growth aspirations.

The business benefits? Well, let’s just say they weren’t pie in the sky. They achieved a whopped 30% increase in operational efficiency and saw investor confidence soar to unprecedented levels. The company’s market valuation doubled in a matter of months, and they found themselves attractively positioned for future mergers and acquisitions. All of this stemmed from a thoughtful investment in a corporate finance consultant who understood the nuances of services, fees, and business benefits, and it turned out to be a defining moment in their corporate journey.

So, what’s the moral of the story here? It’s that the right consultant doesn’t just offer temporary solutions. They equip businesses with lasting tools to manage finance more effectively long-term. They steer you clear of financial booby traps and ensure you capitalize on market opportunities. Ultimately, these partnerships can redefine your business’s trajectory, ensuring not just survival but remarkable success.

Conclusion: Unlocking Strategic Value

Your corporate finance consultant: services, fees, and business benefits essentially act as multipliers for your business arsenal. It’s about finding those financial sweet spots that propel your business forward and mitigate risks before they become existential threats. It’s an ongoing process that involves collaboration, transparency, and commitment from both parties. So, whether your firm is navigating choppy waters or cruising through smooth seas, having a financial guru to guide you can redefine what success looks like for your company.

In a nutshell, businesses today can’t afford to be casual about their approach to finance. As markets evolve, consumer behaviors shift, and economic pressures mount, having that razor-sharp strategic edge becomes more critical than ever. Deciphering corporate finance consultant services, considering their fees, and optimizing business benefits often spells the difference between stagnant growth and new heights of achievement. So, take the plunge, find the right partner, and let your business bask in the fruits of informed financial strategies. Remember, success is not just about having a plan; it’s about having the best plan. And your corporate finance consultant is the ace in your deck that makes this happen.