Yo, welcome to the ultimate guide on credit card processing fees for businesses. If you’re running a biz and dealing with these fees feels like learning a new language, you’re in the right spot! We’re breaking it down, so grab a coffee, or whatever gets you through the grind, and let’s dive into this world of fees that everyone loves to hate.

Understanding the Basics of Credit Card Processing Fees

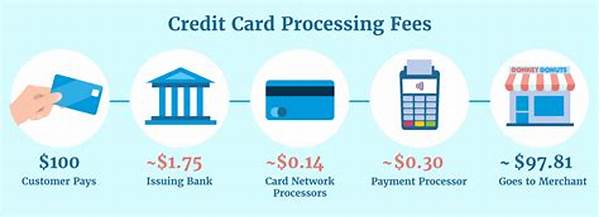

Alright, so before we start throwing around terms like interchange fees and merchant rates, let’s get clear on what credit card processing fees for businesses really are. When a customer swipes, dips, or taps their card, a bunch of money stuff happens behind the scenes — this involves banks, credit card companies, and processors. Each wants their piece of the pie! So, these fees are basically the cost you pay to enjoy the convenience of accepting card payments. Yeah, it feels like daylight robbery sometimes, but it’s part of the game. Most businesses cough up around 1.5% to 3.5% per transaction. It might seem small, but it adds up!

Now, why do you even need to worry about these fees? Simple, my friend – because they chip away at your profits! And if you’re not careful, they can munch away more than you’d like. The trick is to understand what you’re being charged for so you can shop around or negotiate better rates. Ignorance is not bliss when it comes to handling money. So, hang tight as we unravel the mysteries of these soul-taxing fees.

Types of Credit Card Processing Fees You’ll Encounter

1. Interchange Fees: These are like the godfathers of credit card processing fees for businesses. They’re set by the banks and are non-negotiable. Think of them as a necessary evil for the privilege of accepting card payments.

2. Assessment Fees: These come from the credit card networks. Consider them the little extra that Visa or MasterCard charges just because they can. It’s a small percentage of each transaction.

3. Processor Fees: Your payment processor also wants some love. This fee can vary greatly, and you often have a chance to negotiate these bad boys. They’re for services and equipment.

4. Monthly Statement Fees: Yep, just for sending you a summary of how much you owe in fees, they charge you another fee. It’s almost poetic.

5. PCI Compliance Fees: Security doesn’t come cheap, my friend. This fee ensures your business complies with data security standards set to protect card information.

Breaking Down How These Fees Impact Your Bottom Line

Look, when it comes to running a business, every penny counts, right? That’s why understanding credit card processing fees for businesses is crucial. They might not break the bank per transaction, but over time? They can be the slow leak in your balloon. Let’s say your business processes $10,000 in credit card payments a month with a 3% processing fee – that’s $300. Now, imagine investing those $300 in marketing or product development instead. Sounds sweet, huh?

So, what’s the action plan? First, review your fee structure; if it’s feeling like Too Much™, maybe it’s time to have a little chat with your service provider. Can you get a better deal? Is switching providers the way to go? Remember, the goal here isn’t just to understand these fees. It’s to minimize them and their impact on your budget so you can keep more hard-earned cash in your pocket and fuel your growth.

Tips on Minimizing Credit Card Processing Fees

1. Negotiate with Providers: Always try to negotiate better rates for your credit card processing fees for businesses. Providers are competitive and sometimes amenable to cutting down rates to win your business.

2. Choose the Right Pricing Model: Tiered pricing feels simpler, but interchange-plus pricing can be more transparent and cost-effective in the long run.

3. Minimize Chargebacks: Chargebacks are like unexpected paper cuts to your wallet. Avoid them to keep extra fees at bay and maintain a healthier relationship with your processor.

4. Adopt New Technology: Embrace technology like EMV chip readers. They often involve fewer fees due to their added security, because no one likes fraud, not even the card companies.

5. Regularly Review Your Statements: Don’t let fees sneak up on you. Regular audits ensure you’re aware of what’s being charged and if there are unnecessary fees you can eliminate.

The Future of Credit Card Processing Fees

Fellas, the world of business is changing faster than ever. And the same goes for credit card processing fees. As technology evolves, we’re seeing more digital wallets and contactless payments slide into the scene, which may or may not affect these fees. Businesses will dance to the tune of these changes, and staying informed is key. So, keep an eye on trends, new tech, and innovative payment solutions that might help reduce those pesky fees.

And don’t be shy to push back or query your service providers about new solutions or pricing models. Remember, staying on top of the game means being proactive, not reactive. The finer details of these fees may evolve, but your control over how they impact your biz will always be in your hands.

Conclusion: Wrapping Your Head Around Credit Card Processing Fees

To wrap it up, dealing with credit card processing fees for businesses isn’t exactly the highlight of running a biz, but it’s essential. It’s like paying a little “modern business tax” for letting people swipe their magic cards. Know what you’re paying for, understand how it impacts your biz, and look for ways to trim the fat.

When you’re well-equipped with knowledge about these fees, they become less intimidating and more something you can manage. Make smart decisions, seek out better rates, and stay updated with the latest payment trends. Before long, you’ll turn these fees from budget bullies into manageable business costs, all while keeping that bottom line as healthy as possible.