Hey, peeps! Welcome to the ultimate guide to understanding corporate financial planning strategies, explained in the funkiest way possible. If you’ve ever wondered how big companies keep their financial game on point, you’re in the right place. Let’s dive into the world of numbers and nerds, but with a twist of coolness and a splash of sarcasm. Buckle up, because it’s about to get rad in here!

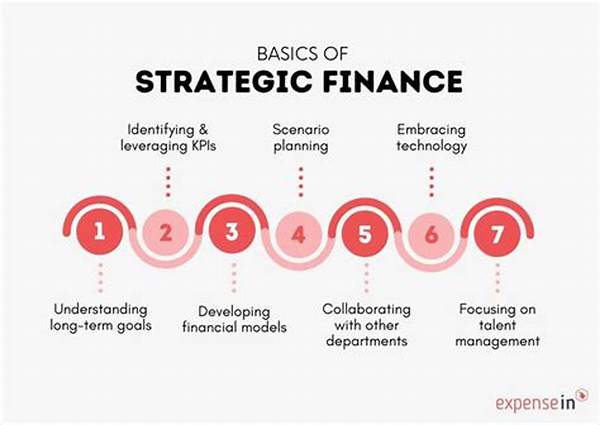

The Basics of Corporate Financial Planning

Alright, let’s break this down. Financial planning for corporations isn’t just about counting beans or making it rain cash. Nah, it’s all about strategically maneuvering through the financial jungle to ensure the company runs smoother than your mom’s peanut butter. Essentially, corporate financial planning strategies explained is all about making informed decisions that keep the company’s finances in check.

Imagine you’re playing a complex game, and money is your ultimate power-up — that’s what financial planning feels like. From budgeting for major expenses to predicting how market trends might impact revenue, it’s about staying ahead of the curve. In this realm, every dollar is a soldier in your financial army, and the plan is your battle strategy. You want profits to soar higher than your cousin’s kite, with losses as minimal as your attention span on a Monday morning at work.

But hold up, it’s not just number-crunching. Think of it like having X-ray vision into your corporate wallet. You’re checking out potential opportunities, scouting out risks like a ninja, and ensuring everything aligns with the big boss’s long-term vision. The art of corporate financial planning strategies explained is seeing the unseen and predicting the unpredictable. So, if you thought managing a corporation’s buncha bucks was just another day at the office, think again!

Key Techniques in Corporate Planning

1. Budgeting and Forecasting

Let’s talk bread and butter — budgeting and forecasting. It’s like planning a road trip with your friends: you don’t just fill up the tank and hope for the best. Similarly, companies map out where each dollar goes and forecast the future to dodge any financial potholes. You’re looking at everything from operational costs to potential profits — major key alert in any corporate financial planning strategies explained.

2. Risk Management

Ever heard of “no risk, no reward”? In corporate speak, that couldn’t be truer. Firms need to assess the risks of every move they make because financial planning ain’t legit without a little risk mania. This is when they bust out their crystal ball, gaze into the futures market, and hedge their bets like Wall Street hustlers.

3. Investment Analysis

Yup, it’s part of the grand plan. Companies analyze potential investments with a microscopic eye. They want to make sure they invest in projects that bring home the bacon. It’s like choosing which fried food to binge on — not all options are gonna fill the need.

4. Cash Flow Management

Think of cash flow as the oxygen for your corporate lungs. Without it, businesses would choke. It’s all about ensuring that there’s enough cash coming in to cover the cash going out. It’s like keeping your fridge stocked with essentials — it’s a basic need.

5. Strategic Cost Management

This bad boy is all about controlling expenses. Companies love to save while still going full throttle in their ventures. Efficiency is the name of the game, and strategic cost management is about finding that sweet spot between quality and cost.

The Art of Long-Term Planning

So, let’s chat about the long game. When it comes to corporate financial planning strategies explained, playing the long-term game is essential. Why? Because businesses gotta think like pro chess players, plotting moves way before the opponent (usually financial chaos) makes theirs. Long-term planning isn’t just about thinking to the end of the fiscal year; it’s about crafting a vision that carries them through the next decade.

This isn’t some “cross your fingers and hope for the best” kind of deal. It’s more like a well-rehearsed ballet, where every plie aligns with the overarching vision of where the company wants to be. Think of it as a colossal jigsaw puzzle, where each piece represents a different aspect of the company — from marketing and human resources to product development and financials. Combining all these pieces seamlessly is what defines successful corporate financial planning strategies explained.

The Importance of Flexibility

Oh, and with all this talk about planning, don’t think that flexibility isn’t on the menu. The world of business is unpredictable, like trying to balance a checkbook on a rollercoaster. Companies need to pivot faster than a cat chasing a laser pointer. Flexibility in financial planning means being ready for a new direction at a moment’s notice, adjusting sails when the economic winds change, and always, always having a Plan B, C, and maybe even D.

Adder: being in tune with market trends and political happenings globally. Having agile financial strategies isn’t just beneficial — it’s vital. Stay woke and adjust those spreadsheets accordingly.

Wrapping it Up

And there you have it, folks. A deep dive into the wild world of corporate financial planning strategies explained. The gist? It’s all about being prepared, having a vision, seeing opportunities, and dodging risks like a fiscal ninja. Companies work tirelessly to get their financial swag on point, and now, you know the behind-the-scenes of how they orchestrate that financial symphony.

With all these insights, you’re ready to impress at the next cocktail party or simply understand why your stocks aren’t as sky-high as you’d wish. Remember, the financial world can be a chaotic landscape, but with the right strategies, it’s possible to glide through it with poise and a sprinkle of style. Stay savvy!