In the dynamic world of business, financial decisions can make or break a company’s future. Enter the corporate finance consultant: the brainy strategist who helps businesses navigate the complex financial landscape. Whether you’re a startup trying to figure out funding, or an established company looking to optimize your balance sheet, these consultants become your go-to financial sleuths. They bring a wealth of expertise to the table, offering services that range from financial analysis to strategic planning, making them invaluable allies in the pursuit of financial success.

Understanding the Role of a Corporate Finance Consultant

When people hear “corporate finance consultant,” their minds might go straight to someone in a suit waving a calculator. But there’s so much more to it. A corporate finance consultant is like a financial maestro, orchestrating the many moving parts of a business’s financial symphony. They dive into numbers, sure, but they also offer insights into market trends, risk management, and future investments. It’s a position that requires not only technical skills but also strategic thinking and a deep understanding of the client’s industry.

Here’s where it gets interesting, though. While they may know their way around a balance sheet, experts suggest keeping it real and approachable is vital. No one wants to sit through a consultation that feels like a finance lecture from a textbook. By infusing everyday language and a bit of flair, consultants can communicate complex financial strategies in a way that actually makes sense. A good corporate finance consultant: services, fees, and how to choose guide will also consider this human element, ensuring they match you with someone who doesn’t just talk numbers, but genuinely clicks with your team.

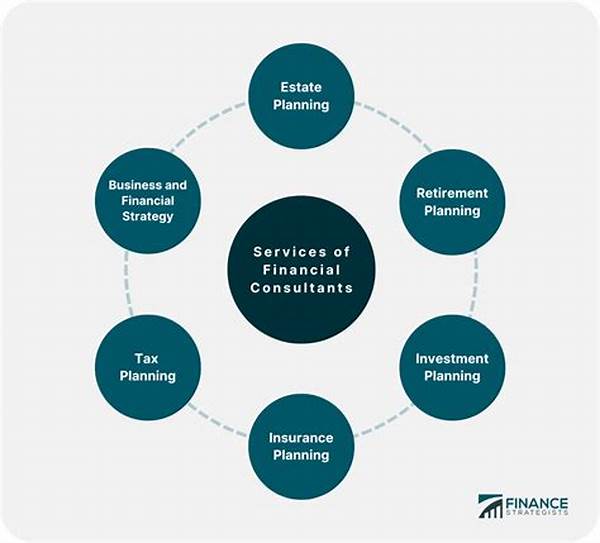

Key Services Offered by Corporate Finance Consultants

When diving into the maze of corporate finance consultant: services, fees, and how to choose, it’s crucial to know what’s on offer:

1. Financial Strategy Development: They craft financial blueprints that align with your business goals. It’s like creating a personalized map for your business journey to ensure you stay on the right path.

2. Risk Management: Identifying potential financial risks and laying out strategies to mitigate them. Think of it as having a financial safety net ready to catch your back when the times get tough.

3. Investment Analysis: They dig deep to assess where you should put your money to make it grow. No more blind gambling—these folks show you how to invest smartly.

4. Valuation Services: Ever wonder what your business is really worth? These experts break down the nitty-gritty to give you a clear picture of your current value on the market.

5. Mergers and Acquisitions: Got plans to grow big or merge with another business? Consultants handle all the complex bits, leaving you to focus on what matters—running your business.

Decoding Consultant Fees

Navigating the realm of corporate finance consultant: services, fees, and how to choose can be like navigating a jungle, especially when it comes to fees. Let’s break it down.

Typically, corporate finance consultants might charge a flat fee or hourly rates, depending on the complexity and scope of the project. Some might even have a retainer model, where you pay a fixed monthly sum for ongoing assistance. It can get a bit pricey, but remember: you’re investing in expertise that could level-up your entire financial game.

Here’s the thing—don’t get blinded by the costs alone. Consider the value they bring to your company. Their insights could drive significant business growth, potentially outweighing the initial fees. You want someone who knows their stuff, sure, but also someone you vibe with. After all, you’ll be working closely with them to hit your business milestones. The right corporate finance consultant: services, fees, and how to choose guide will help you balance expertise with cost and chemistry.

Tips for Choosing the Right Consultant

Choosing the perfect consultant is like picking a co-pilot for your financial journey. Here’s a quick guide:

1. Check their Track Record: Look for someone who’s got a solid background in your industry. Their past successes are like cheat sheets to their expertise.

2. Define Your Needs Clearly: Get your priorities straight to find a consultant who can deliver exactly what you need, whether it’s financial restructuring, strategic planning, or other services.

3. Ask for References: Get the low-down from their past clients. Knowing how they’ve helped others can provide clarity on what they might bring to your table.

4. Meet Several Candidates: Don’t settle for the first consultant you meet; have a chat with a few. It’s important to find someone who understands what makes your business tick.

5. Trust Your Instincts: Ultimately, you’re choosing a partner in this financial adventure. If you feel comfortable and confident in their abilities, that’s a good sign you’ve found the right one. A solid corporate finance consultant: services, fees, and how to choose guide will highlight these key steps in your decision-making process.

Making the Most of Corporate Finance Consultancy

Once you’ve secured your corporate finance consultant, it’s about making the collaboration work like a well-oiled machine. First, set clear communication channels. Keep everything transparent and establish regular check-ins. It ensures everyone’s on the same page, working toward those clearly defined goals.

Second, provide ample context about your business. The more they understand your operations and goals, the better their guidance will be. And third, keep an open mind. While their advice might challenge existing beliefs, remember you’re paying for their expertise to see things differently.

By focusing on these aspects, you’re setting the stage for a fruitful relationship, making the most out of your investment, and leveraging the full spectrum of corporate finance consultant: services, fees, and how to choose.

Wrapping Up

Trying to navigate the intricacies of the financial world on your own is daunting, no doubt. That’s where a corporate finance consultant steps in, shedding light on those dimly lit paths of fiscal challenges. Armed with insights into corporate finance consultant: services, fees, and how to choose, you can now make informed decisions, aiming for growth while steering clear of pitfalls.

From understanding services to decoding fees and mastering the art of consultant selection, all these pieces play a crucial part in your financial success story. Choose wisely, and your consultant could become one of your most valuable allies.