Yo guys! So you’re probably running a biz empire and thinking, “What if things go sideways?” Enter commercial insurance coverage for corporate risk protection, your knight in shining armor. It’s like that hero you didn’t know you needed, but when chaos comes knocking, you’re hella grateful you have it. In this guide, we’re diving deep into how you can safeguard your corporate assets and keep that money machine purring like a kitten. Let’s go!

Why You Need to Get Real About Commercial Insurance Coverage

Alright, picture this: Your business is cruising smoothly, sales are through the roof, and everyone’s talking about you. But then, bam! Disaster strikes — theft, fire, or even a lawsuit. Enter commercial insurance coverage for corporate risk protection, the unsung hero of the business world. Think of it as that cool friend who always has your back no matter what chaos erupts. It’s like the seatbelt for your business’s rollercoaster ride.

With the right commercial insurance, you’re basically putting a safety net under your corporate tightrope walk, ensuring that one slip doesn’t dunk you into financial doom. It’s vital for every business mogul, no matter how big or small your empire is. Whether you’re running a startup from your garage or a multinational enterprise, understanding this coverage is essential. But hey, don’t just take my word for it — explore what it can do for you and your business!

When you dive into the pool of commercial insurance coverage for corporate risk protection, you’re unlocking a treasure trove of benefits. It doesn’t just protect against property damage; it also shields you from the financial hemorrhage due to liabilities or employee-related risks. It’s basically your corporate armor against adversity. Let’s be honest, guys, being proactive is way cooler than being reactive, and with commercial insurance, you’re always ahead of the curve.

What Types of Commercial Insurance Should Bosses Know About?

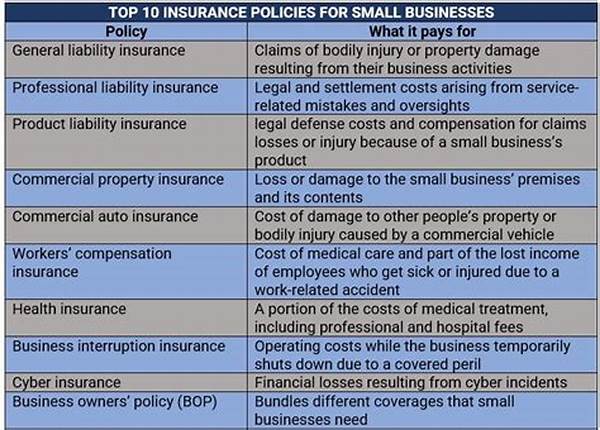

1. General Liability Insurance – Okay, first on the list is the good old general liability. This bad boy’s like an all-in-one protective shield against bodily injury claims, property damage, and legal fees. No more losing wads of cash over unexpected lawsuits.

2. Property Insurance – Protect your empire’s physical assets like buildings, office furniture, and inventory. Imagine a catastrophe hitting your office space — without this coverage, it’s like watching your cash go up in flames.

3. Workers’ Compensation – Got employees? Then you’ve gotta look out for their welfare. This coverage swoops in when your peeps get injured on the job, giving you peace of mind and avoiding those hefty medical costs and legal hassles.

4. Business Interruption Insurance – This coverage is like having a clone business operation ready to go if yours hits a halt due to some disaster. Keeps the money flowing even when everything else seems to stop.

5. Cyber Liability Insurance – In the digital age, cyber threats are real monsters. Protect your biz from data breaches and cyber-attacks. With cyber liability, commercial insurance coverage for corporate risk protection gets a futuristic upgrade!

How to Find the Right Commercial Insurance Package for Your Business

Navigating the complex world of commercial insurance coverage for corporate risk protection can feel like finding the mythical unicorn. But with the right compass, aka strategic planning, you can figure out exactly what your business needs. Start by assessing potential risks in your specific industry and don’t shy away from consulting with an insurance guru who’s got the street smarts in policies.

Remember, finding the right package isn’t just about getting maximum coverage; it’s about getting what’s relevant for your business and within your budget. Picture it like putting together an insurance cocktail — you need the right mix of policies that complement each other. Whether it’s liability coverage, property insurance, or cyber protection, each piece is a crucial part of your overall protection strategy.

Venturing into commercial insurance coverage for corporate risk protection isn’t a one-size-fits-all approach. It’s all about catering to what’s best for you. Dive deep, evaluate options, compare quotes, and above all, grasp the fine print. You’ll thank yourself later for taking the plunge with the right foresight and dedication to your biz protection!

Common Mistakes to Avoid When Choosing Commercial Insurance

1. Underestimating Risk – Ignorance ain’t bliss! Know your potential hazards; being prepared keeps financial disasters at bay.

2. Overlooking Policy Details – Those tiny fine print bits? Yeah, they matter. Know what you’re buying so there are no “uh-oh” moments later on.

3. Neglecting Updates – Your biz isn’t static; neither should your insurance be. Keep it updated as your operations expand or change.

4. Not Comparing Providers – Shopping around isn’t just for groceries! Different providers offer different perks — find what gels with your biz needs.

5. Ignoring Employee-related Coverages – Your team matters; coverage like workers’ comp isn’t just obligated — it’s smart!

Future-Proofing Your Business with Commercial Insurance Coverage

Let’s face it; running a business isn’t just about profits and scaling up. It’s also about preparing for the unexpected whims of life. Future-proofing your venture with robust commercial insurance coverage is akin to planting a financial firewall around your empire. It becomes your safety valve, an essential part of your contingency plan, hardwiring stability into your operations.

These days, risks are uncountable, from environmental catastrophes to cyber threats — you never know when you might get hit. Having commercial insurance coverage for corporate risk protection aligns you in a proactive stance, firm and ready to tackle any hiccup with finesse. Imagine steering your company ship smoothly through the roughest of waters — that’s the vibe!

Embracing commercial insurance coverage for corporate risk protection doesn’t just buy you peace of mind; it also opens doors for smoother business transactions and operations. Stakeholders and partners prefer to engage with companies that have robust risk management frameworks, as this minimizes uncertainties. In essence, you’re not just protecting what you’ve got but laying a robust, formidable pathway for growth. In the vast ocean of commerce, being prepared is the currency of champions!

Summary: Nailing the Art of Strategic Protection

As you juggle through the fast-paced lanes of business management, remember: commercial insurance coverage for corporate risk protection is your silent partner, always backing you. Think of it like Bruce Wayne and Batman vibes — you need both to truly guard and nurture your Gotham City of a business. Also, staying informed and proactive prevents a lot of “doh!” moments down the line.

Ready to level up? Start now by examining where you stand, evaluating your risk perception, and dovetailing your insurance needs accordingly. Whether you’re guarding a humble startup or a colossal enterprise, ensuring unique personal solutions can forge a resilient business armor.

At the core, the landscape is bound to transform, but with the savvy armor of commercial insurance coverage for corporate risk protection, you’re not just surviving; you’re thriving. Let’s grow and adapt, one insured stride at a time. ✌️