Yo, welcome to the ultimate guide where we’re gonna break down the whole deal about commercial insurance like you’re chatting with a friend over coffee. We all know insurance talk can be a snooze fest, but don’t worry, I’ve got your back. So, let’s dive into the world of commercial insurance policies cost & coverage explained, alright?

The Basics of Commercial Insurance Policies

Alrighty, let’s kick things off with the basics, fam! So, you’re running a business and you’ve heard you need insurance, but what’s that all about? Commercial insurance is like a superhero cape for your business, protecting it from unexpected drama. You know, unpredictable stuff like fires, theft, or even a lawsuit from an unhappy customer. The commercial insurance policies cost & coverage explained here is all about making sure you get the right protection without spending all your coins. Think of it like Netflix for your business—you’re covered for all sorts of scenarios, but you gotta know what’s in the package. The cost? Well, that can be like ordering a coffee; it depends on what you want. More coverage might mean a pricier policy, but it’s peace of mind, right?

Factors Influencing Insurance Costs

Now, why does the cost of commercial insurance vary like your mood on a Monday morning? Here’s the lowdown:

1. Type of Business: A construction company ain’t paying the same as a bakery, my friend.

2. Location: High-traffic city area? Your rates might be as high as that rent.

3. Claims History: If your business has faced claims before, better brace for higher costs.

4. Coverage Amount: More coverage equals more bucks, simple as that.

5. Business Size: Bigger business, bigger risks, bigger premiums. See the pattern?

That’s the commercial insurance policies cost & coverage explained, quick style!

Types of Coverage You Need to Know

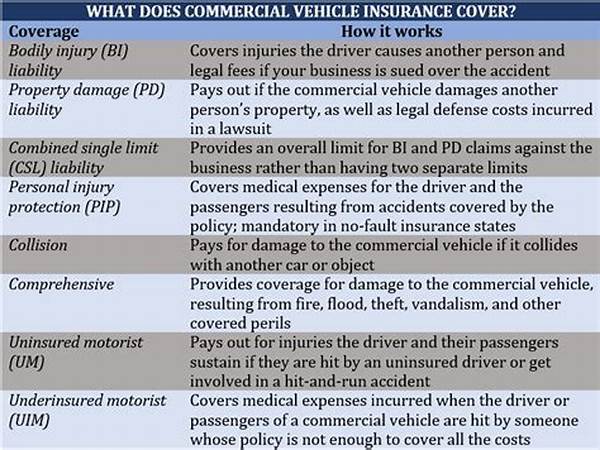

Now, let’s get into the nitty gritty, folks. The commercial insurance policies cost & coverage explained here includes tons of different coverages but, hey, these are the must-knows. What do you absolutely need? Liability insurance, property coverage, and workers’ compensation are the biggies. Liability insurance is like having a bodyguard, protecting you from legal sue-me’s. Then there’s property coverage, which is your metaphorical fire extinguisher, saving your goods from literal disaster. Workers’ compensation keeps your crew covered in case of any workplace mishaps—major key for the peace of mind! And boy, let’s not forget commercial auto insurance if you’ve got wheels for your biz. Make sure to scope out what’s legit for your gig because commercial insurance policies cost & coverage explained will help you sleep easy at night.

How to Save on Commercial Insurance

Okay, we all love a good deal, right? Here are tips to keep them dollar bills in check:

1. Shop Around: Don’t marry the first policy you see.

2. Bundle Policies: Like bundling your WiFi and phone – more savings!

3. Risk Management: Reduce your risks, and you’ll reduce costs.

4. Security Systems: Invest in good security and insurers will praise you.

5. Increase Deductibles: Pay more upfront if you can, for lower premiums.

That’s how you play the game of commercial insurance policies cost & coverage explained to your favor!

Common Mistakes to Avoid

With all that info, it’s easy to trip and fall. Let’s dodge those beginner pitfalls:

1. Underestimating Coverage: Being cheap now might cost you later.

2. Overlapping Policies: Don’t pay for double coverage – it’s super unnecessary.

3. Ignoring Exclusions: Read the fine print like it’s your favorite novel.

4. Not Updating Policies: Your business grows, your coverage should too.

5. Skipping Reviews: Make a yearly insurance date with your agent.

Knowing these common traps makes commercial insurance policies cost & coverage explained smarter and smoother.

When and Why You Should Review Policies

Once you’ve snagged your coverage, it ain’t over. Policies are like pets; they require attention, buddy. Businesses grow and change—a new location, more employees, or just shifting needs. That’s why commercial insurance policies cost & coverage explained means checking in regularly. Don’t forget annual check-ins with your insurance pros to make sure your coverage is as fly as you are. Changes in the law or recent claims might affect what you need; don’t get caught slippin’ without the right coverage.

Wrapping It Up with a Bow

There you have it, folks! This journey through commercial insurance policies cost & coverage explained hasn’t just been fun but an essential part of adulting as a business owner. What’s the takeaway? Stay informed, keep your policies updated, and never settle for the first thing you see. With a little savvy, you’ll keep your biz protected without draining the bank account. So, next time someone throws the words “commercial insurance” at you, you can just nod knowingly, because you’ve got the deets and they can’t fool you. Peace out!