Yo, What’s Up with Corporate Stability?

Alright, fam, let’s dive into this intriguing world of financial risk consulting for corporate stability. Trust me, even if you think finance is dry as dust, this is gonna be a fun ride! Picture this: your favorite brand launching a super-risky product without thinking about the ‘what ifs’. Sounds nuts, right? Well, that’s where financial risk consulting steps in. It’s like having a financial life coach who’s got your back when the going gets tough. For real, financial risk consulting for corporate stability is what every business needs to survive and thrive in this fast-paced, unpredictable world. Without it, companies are like boats without oars – directionless and drifting.

What Is Financial Risk Consulting?

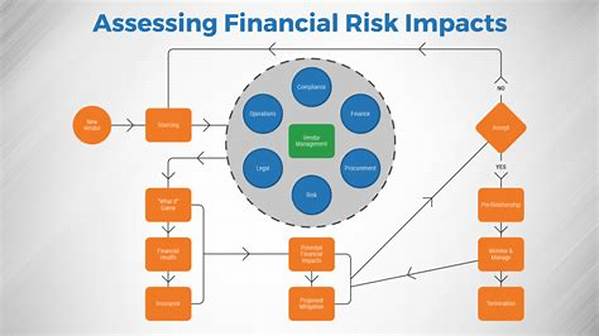

If you’re asking why you’d need financial risk consulting for corporate stability, lemme break it down for you. It’s pretty much a strategy sesh where consultants identify risks that can potentially mess with a company’s money flow. They brainstorm ways to keep the corporate ship stable and afloat. Imagine you’ve got a financial superhero team that spots dangers lurking around the corner way before they hit you. They look at every nook and cranny of a business to ensure there’s nothing lurking that can throw your company off track. So yeah, financial risk consulting is essential if you want your company to be the sleek, well-oiled machine you envision.

Consultants dive deep into the financial underbelly of a company. They check out market trends, study historical data, and even peer into the mysterious realm of future projections. Honestly, they leave no stone unturned in their pursuit of corporate stability. It’s like having a full-blown financial health check-up. The best part? They ensure that when any financial hiccup threatens to upset the apple cart, it’s tackled with expertise, leaving your corporation steady as a rock. Remember, financial risk consulting for corporate stability isn’t just about dodging bullets—it’s about setting up a fortress well in advance.

Ingredients of a Rock-Solid Consulting Strategy

1. Risk Assessment: This is where they identify all the dodgy areas that could potentially rain on your financial parade. Think of it as an ultra-thorough detective work where they sniff out anything that smells fishy.

2. Market Analysis: Staying tuned to market trends is vital. Consultants basically keep their ears to the ground to catch any seismic financial shifts heading your way.

3. Scenario Planning: Ever thought about what’d happen if doomsday hit your finances? These consultants have. Planning for worst-case scenarios is part of the gig.

4. Protective Measures: It’s all about building the right defense mechanisms. Whether it’s insurance or financial reserves, they ensure you’re covered when times get tough.

5. Regular Reviews: Financial landscapes change faster than fashion trends. Regular check-ins ensure the plan is up-to-date and foolproof.

Why The Fuss About Financial Risk?

Okay, so, here’s the lowdown on why financial risk consulting for corporate stability is a must-do. Companies operating in today’s world deal with worldwide competitors, unpredictable markets, and even economic uncertainties that rise like sudden summer clouds. You gotta be prepared, right? Otherwise, you’re just another sitting duck waiting for the inevitable.

Here’s the thing—financial risks can come from anywhere. Be it fluctuating currency rates, stock market ambiguities, or even internal upheavals, they spelled trouble with a capital T if not handled well. It’s no surprise that with little to no financial foresight, many seemingly unstoppable corporations have stumbled hard. That’s why firms are lining up for financial consulting. They’ve realized that rolling the dice isn’t the safest business strategy after all. Just like how you need shades to block out the sun’s blinding rays, financial risk consulting helps protect companies from harsh financial glare and leads them to clear skies of stability.

How It’s Done: The Consulting Process

Trust me, folks, the process behind financial risk consulting for corporate stability is anything but dull. These consultants are financial wizards. They cast a wide net to capture all data, analyze it, scrutinize every detail, and ultimately craft a strategy that’s bulletproof. It’s like alchemy, turning raw data into golden insights. They make sure your business is not just surviving but also thriving. Financial risk consulting turns the table by equipping businesses with structured game plans that avoid pitfalls they didn’t even know existed.

With all the cool tech tools today, consultants can forecast and simulate potential risks way before they rear their ugly heads. They work round-the-clock to tether businesses to the ground during storms of financial insecurity. So yeah, it pays big time to invest in sound financial risk consulting cause at the end of the day, it’s all about keeping the corporate ship sailing smoothly, no matter how rough the seas get.

The Final Analysis: Secure Those Finances!

In closing, peeps, we can’t stress enough the importance of financial risk consulting for corporate stability—it’s like the GPS that keeps a business on course amidst a financial maze. Imagine navigating stormy seas without a compass. That would be madness, right? Well, financial risk consulting acts as that compass, steering corporations away from financial fiascos and keeping them on stable, profit-laden paths. It’s about transforming possible hazards into opportunities, adapting to market changes creatively, and ironing out any kinks before they turn into catastrophes.

Flying blind is no option when your company’s legacy and employees’ futures are on the line. So, get the experts onboard. With a steady hand guiding the wheel, your business isn’t just playing safe—it’s setting up for success. Remember, in this unpredictable financial world we live in, foresight is the name of the game, and financial risk consulting is your MVP for corporate stability. Cheers to keeping it steady and solid, folks!